Islamic bonds expected to decline further in 2016

Islamic bonds expected to decline further in 2016

Islamic bonds declined 45.4 percent in 2015 compared to the previous year and are expected to decline further in 2016, but are still viewed as the more 'ethical loans.'

3 min read

Islamic banking is a growing industry in Europe [Getty]

The value of sukuk (Islamic bonds) is expected to continue to drop in 2016 after the sharp dive last year, the Standards & Poor's rating agency said on Wednesday.

The rating agency forecasts that the issuance of sukuk will drop to between $50 billion and $55 billion this year, a decline of 13-21 percent.

In 2015, sukuk worth $63.5 billion were issued in 2015 compared with $116.4 billion in the previous year, a 45.4 percent decline.

The drop was largely due to Malaysia's central bank, one of the largest global providers of the product, which stopped issuing sukuk.

It issued $50 billion of sukuk alone in 2014.

With Malaysia removed from calculations, sukuk would have dropped just 5 percent in 2015, S&P said.

The drop in sukuk comes after years of double-digit growth in the Islamic sharia-compliant bonds.

'Three main factors'

Other major factors negatively impacting sukuk include low oil prices and the hike in US interest rates, both of which are expected to drain liquidity.

"In our view, three main factors will shape the performance of the sukuk market in 2016: monetary policy developments in the US and Europe, the drop in oil prices, and the possible lifting of sanctions on Iran," said S&P global head of Islamic finance, Mohammad Damak.

"If oil prices remain weak, some governments of oil-exporting countries in the Gulf Cooperation Council (GCC) and Malaysia may have no other choice than to reduce investment spending, resulting in lower financing needs and potentially lower issuances (conventional and Islamic)," Damak said.

Oil prices plunged close to $33 a barrel on Thursday, as crude extended losses on rising US energy stockpiles and China's weakening currency.

What was once touted as the future of banking now looks tied to oil prices and the economic resilience of the Gulf states' economies.

Conventional bonds

S&P said that energy-rich Gulf Cooperation Council (GCC) states opted for conventional bonds rather than sukuk to finance their deficits because of complex procedures involving the issuance of sukuk.

Last year, conventional bonds issued by GCC states jumped 140 percent to $58 billion while sukuk dropped by 22 percent to $18 billion.

This came after four years in which conventional bonds and sukuk remained almost equal.

The issuance of debt by GCC states last year, both sukuk and bonds, jumped by 60 percent to $75 billion mainly to finance budget deficits.

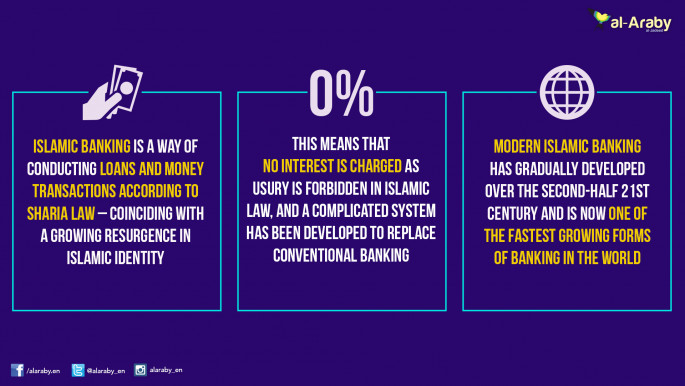

Islamic banking is still viewed as a more ethical way of obtaining loans in the Gulf.Unlike conventional bonds, which give ownership of debt, sukuk are asset-based securities that give investors a share because Islamic sharia law prohibits interest-bearing debt.

The rating agency forecasts that the issuance of sukuk will drop to between $50 billion and $55 billion this year, a decline of 13-21 percent.

In 2015, sukuk worth $63.5 billion were issued in 2015 compared with $116.4 billion in the previous year, a 45.4 percent decline.

The drop was largely due to Malaysia's central bank, one of the largest global providers of the product, which stopped issuing sukuk.

It issued $50 billion of sukuk alone in 2014.

With Malaysia removed from calculations, sukuk would have dropped just 5 percent in 2015, S&P said.

The drop in sukuk comes after years of double-digit growth in the Islamic sharia-compliant bonds.

'Three main factors'

Other major factors negatively impacting sukuk include low oil prices and the hike in US interest rates, both of which are expected to drain liquidity.

"In our view, three main factors will shape the performance of the sukuk market in 2016: monetary policy developments in the US and Europe, the drop in oil prices, and the possible lifting of sanctions on Iran," said S&P global head of Islamic finance, Mohammad Damak.

|

If oil prices remain weak, some governments... in the (GCC) and Malaysia may have no other choice than to reduce investment spending - Head of Islamic finance at S&P Mohammad Damak |

|

"If oil prices remain weak, some governments of oil-exporting countries in the Gulf Cooperation Council (GCC) and Malaysia may have no other choice than to reduce investment spending, resulting in lower financing needs and potentially lower issuances (conventional and Islamic)," Damak said.

Oil prices plunged close to $33 a barrel on Thursday, as crude extended losses on rising US energy stockpiles and China's weakening currency.

What was once touted as the future of banking now looks tied to oil prices and the economic resilience of the Gulf states' economies.

Conventional bonds

S&P said that energy-rich Gulf Cooperation Council (GCC) states opted for conventional bonds rather than sukuk to finance their deficits because of complex procedures involving the issuance of sukuk.

Last year, conventional bonds issued by GCC states jumped 140 percent to $58 billion while sukuk dropped by 22 percent to $18 billion.

This came after four years in which conventional bonds and sukuk remained almost equal.

The issuance of debt by GCC states last year, both sukuk and bonds, jumped by 60 percent to $75 billion mainly to finance budget deficits.

Islamic banking is still viewed as a more ethical way of obtaining loans in the Gulf.Unlike conventional bonds, which give ownership of debt, sukuk are asset-based securities that give investors a share because Islamic sharia law prohibits interest-bearing debt.

|