Egypt's wave of privatisation: What does Sawiris really know?

Egypt's wave of privatisation: What does Sawiris really know?

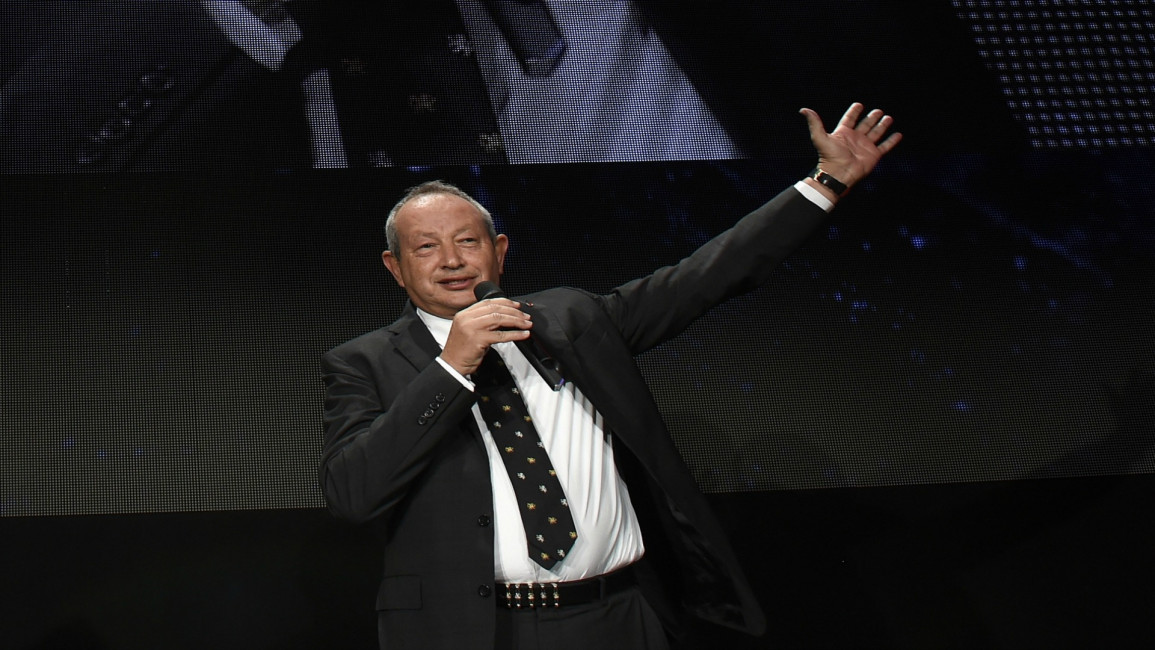

Comment: He already won big from Cairo's sell-off of the telecoms industry, now billionaire oligarch Naguib Sawiris stands to profit hugely in the sale of state-owned banks, writes Ibrahim AlSahary.

5 min read

Since the beginning of the fiscal year, Egypt’s economic position has deteriorated dramatically [AFP]

For nearly a quarter of a century, observers and investors have followed the movements of billionaire Naguib Sawiris to guage which way the wind is blowing in the Egyptian economy - both in the short and medium term.

When Egyptian general Abdel Fattah El-Sisi removed President Mohamed Morsi from power on 3 July 2013, Sawiris promised to invest in his country "like never before".

Two years later, however, the sometimes politician, always shrewd businessman says "he has no desire to invest", demanding economic reform and the privatisation of state-owned companies.

But the truth is this: Sawiris will invest. Like a cunning fox hunting his prey, the Egyptian tycoon is making a move that says much about the economic policies expected in Egypt.

During the past three months, Sawiris has changed his investment strategy to secure a significant share in Egypt's financial sector.

In November 2015, Sawiris took over 100 percent of Beltone Financial, one of Egypt's biggest investment banks. Not only this, but a month later, he presented an acquisition offer to buy 100 percent of CI Capital, the investment-banking unit of Commercial International Bank-Egypt (CIB).

If this acquisition is successful, Sawiris will create a new investment bank that may be able to compete with EFG Hermes, the biggest investment bank in the Middle East.

So why is Sawiris taking this move, and what does he really know that we don't?

"I'm the money man," Sawiris said humbly of himself in 2007. "Wherever I smell money, I go."

At the beginning of 2016, a presidential statement announced that "the coming period will witness offerings of parts of the capital of successful Egyptian companies and banks on the bourse".

Again, a few days ago, Minister of Investment Ashraf Salman stressed that the government would propose, within three months, capital increases for many public sector companies operating in fields including insurance and banking.

To those not in the know, "capital increase" is the polite way to say "privatisation" in a country that has seen countless labour strikes against neoliberal economic policies.

But why has the government decided now to return to public sector privatisation after a break of more than ten years?

Since the beginning of the fiscal year 2015/2016, Egypt's economic position has deteriorated dramatically, the deficit increased to about $10 billion per year, and the level of GCC countries' assistance dropped due to the collapse of oil prices.

The only way out of this crisis, the government and big business both believe, would be approaching international financial institutes such as The World Bank, International Monetary Fund, and other donor agencies.

These donors believe Egypt needs to accelerate economic reforms, and to launch a privatisation programme. A quick look at the conditions set by the World Bank to lend Egypt $1 billion in November 2015 shows that privatisation is a major demand.

In the Chinese classic Art of War, Sun Tzu wrote that "In the midst of chaos, there is also opportunity," and that is what Sawiris saw in Egypt's economic crisis: an opportunity.

The investment bank that Sawiris is attempting to create will be his spearhead in his new hunt for profit - whether this happens through taking over one of the governmental banks put up for sale, or through earning generous commissions and fees generated from equity capital market transactions.

EFG Hermes, Sawiris only real competitor, has raised more than $4 billion since 2014 for 12 equity capital market transactions.

Just a few days ago, Sawiris formed his golden team as he reconstituted Beltone's new board of directors.

The new board has members with ministerial backgrounds - including Mounir Fakhry Abdel Nour, the former trade and industry minister, and former finance minister Ahmed Galal.

It is chaired by Sameh El Torgoman, the former chairman of the Cairo and Alexandria Stock Exchange during Mubarak's golden years of privatisation between 1997 and 2004. The new executive vice-chairman is Maged Shawky, also a former chairman of the Cairo and Alexandria Stock Exchange.

Privatisation is Sawiris' best friend. He built his fortune in the golden years, and is now thought to be worth around $3.1 billion.

Then, like now, Sawiris played his cards right. In 1997, knowing that Egypt would privatise the state-owned Egyptian Company for Mobile Services, he founded Orascom Telecom, a communications company that soon allied with Motorola and France Telecom.

In 1998 this alliance acquired the highly profitable state-owned company.

Privatising the Egyptian Company for Mobile Services (Mobinil) at that time, and the transactions on its shares in the stock market in the following years, raised many doubts.

In 2001, the veteran parliamentarian Kamal Ahmed questioned the government about the role played in finalising the deal played by then-stock market chief Sameh El Torgoman and a number of government ministers.

What could be good news for Sawiris is certainly bad news for others who suffered under Mubarak - as his regime sold a major part of the public sector for less than a quarter of its value in corrupt deals that only benefited Mubarak, his sons, and a handful of business owners.

Egypt's new wave of privatisation, with hardly any change in the legislative environment, will only witness a return to Mubarak-era business practices.

"Privatisation and corruption come hand in hand in this country," said Khaled Ali, a prominent Egyptian labour lawyer.

Poverty and unemployment also come in the same package.

Ibrahim AlSahary is an economist and former executive chief editor of Egypt Independent.

When Egyptian general Abdel Fattah El-Sisi removed President Mohamed Morsi from power on 3 July 2013, Sawiris promised to invest in his country "like never before".

Two years later, however, the sometimes politician, always shrewd businessman says "he has no desire to invest", demanding economic reform and the privatisation of state-owned companies.

But the truth is this: Sawiris will invest. Like a cunning fox hunting his prey, the Egyptian tycoon is making a move that says much about the economic policies expected in Egypt.

During the past three months, Sawiris has changed his investment strategy to secure a significant share in Egypt's financial sector.

In November 2015, Sawiris took over 100 percent of Beltone Financial, one of Egypt's biggest investment banks. Not only this, but a month later, he presented an acquisition offer to buy 100 percent of CI Capital, the investment-banking unit of Commercial International Bank-Egypt (CIB).

If this acquisition is successful, Sawiris will create a new investment bank that may be able to compete with EFG Hermes, the biggest investment bank in the Middle East.

So why is Sawiris taking this move, and what does he really know that we don't?

"I'm the money man," Sawiris said humbly of himself in 2007. "Wherever I smell money, I go."

At the beginning of 2016, a presidential statement announced that "the coming period will witness offerings of parts of the capital of successful Egyptian companies and banks on the bourse".

Again, a few days ago, Minister of Investment Ashraf Salman stressed that the government would propose, within three months, capital increases for many public sector companies operating in fields including insurance and banking.

To those not in the know, "capital increase" is the polite way to say "privatisation" in a country that has seen countless labour strikes against neoliberal economic policies.

|

Donors believe Egypt needs to accelerate economic reforms, and to launch a privatisation programme |  |

But why has the government decided now to return to public sector privatisation after a break of more than ten years?

Since the beginning of the fiscal year 2015/2016, Egypt's economic position has deteriorated dramatically, the deficit increased to about $10 billion per year, and the level of GCC countries' assistance dropped due to the collapse of oil prices.

The only way out of this crisis, the government and big business both believe, would be approaching international financial institutes such as The World Bank, International Monetary Fund, and other donor agencies.

These donors believe Egypt needs to accelerate economic reforms, and to launch a privatisation programme. A quick look at the conditions set by the World Bank to lend Egypt $1 billion in November 2015 shows that privatisation is a major demand.

In the Chinese classic Art of War, Sun Tzu wrote that "In the midst of chaos, there is also opportunity," and that is what Sawiris saw in Egypt's economic crisis: an opportunity.

The investment bank that Sawiris is attempting to create will be his spearhead in his new hunt for profit - whether this happens through taking over one of the governmental banks put up for sale, or through earning generous commissions and fees generated from equity capital market transactions.

EFG Hermes, Sawiris only real competitor, has raised more than $4 billion since 2014 for 12 equity capital market transactions.

|

Privatisation is Sawiris' best friend. He built his fortune in the golden years, and is now thought to be worth around $3.1 billion |  |

Just a few days ago, Sawiris formed his golden team as he reconstituted Beltone's new board of directors.

The new board has members with ministerial backgrounds - including Mounir Fakhry Abdel Nour, the former trade and industry minister, and former finance minister Ahmed Galal.

It is chaired by Sameh El Torgoman, the former chairman of the Cairo and Alexandria Stock Exchange during Mubarak's golden years of privatisation between 1997 and 2004. The new executive vice-chairman is Maged Shawky, also a former chairman of the Cairo and Alexandria Stock Exchange.

Privatisation is Sawiris' best friend. He built his fortune in the golden years, and is now thought to be worth around $3.1 billion.

Then, like now, Sawiris played his cards right. In 1997, knowing that Egypt would privatise the state-owned Egyptian Company for Mobile Services, he founded Orascom Telecom, a communications company that soon allied with Motorola and France Telecom.

In 1998 this alliance acquired the highly profitable state-owned company.

Privatising the Egyptian Company for Mobile Services (Mobinil) at that time, and the transactions on its shares in the stock market in the following years, raised many doubts.

In 2001, the veteran parliamentarian Kamal Ahmed questioned the government about the role played in finalising the deal played by then-stock market chief Sameh El Torgoman and a number of government ministers.

What could be good news for Sawiris is certainly bad news for others who suffered under Mubarak - as his regime sold a major part of the public sector for less than a quarter of its value in corrupt deals that only benefited Mubarak, his sons, and a handful of business owners.

Egypt's new wave of privatisation, with hardly any change in the legislative environment, will only witness a return to Mubarak-era business practices.

"Privatisation and corruption come hand in hand in this country," said Khaled Ali, a prominent Egyptian labour lawyer.

Poverty and unemployment also come in the same package.

Ibrahim AlSahary is an economist and former executive chief editor of Egypt Independent.

Opinions expressed in this article remain those of the author and do not necessarily represent those of The New Arab, its editorial board or staff.