Saudi Aramco, world's largest oil producer, to launch IPO soon despite lingering questions

The company released a lengthy document late on Saturday announcing that the offering period for the world's largest oil producer would begin on November 17.

While the preliminary prospectus revealed that Aramco will sell up to 0.5 percent of its shared to individual retail investors, it did not indicate how much will be made available to institutional investors.

Despite the small ammount on sale, the offering has generated global buzz because even a sliver would make this the world's largest IPO.

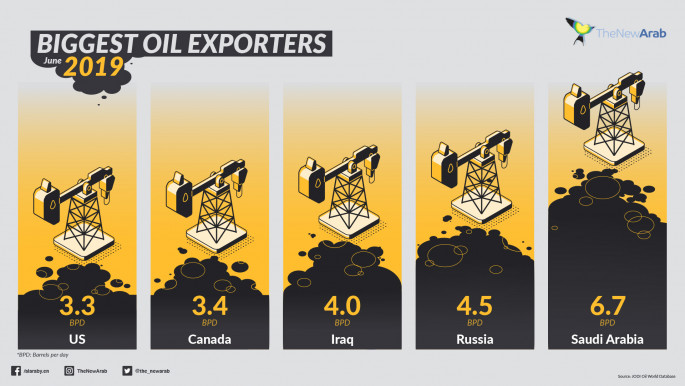

Saudi Aramco pumps more than 10 million barrels of crude oil a day - some 10 percent of global demand.

Despite lurking doubts over Aramco's valuation and how much of the company will ultimately be for sale on the kingdom's Tadawul stock exchange, the company's size and profitability has made it undeniably attractive to potential investors.

The oil and gas company netted profits of $111 billion last year, more than Apple - currently the world's most profitable listed company - Royal Dutch Shell and Exxon Mobil combined.

|

| Read more: How Saudi Aramco is powering the global climate crisis |

Aramco said the long-delayed offering period for investors will begin next Sunday, November 17, and will close for individual investors on November 28 and for institutional investors on December 4. The company's shares will be priced on December 5, according to the prospectus, and trading could begin as soon as December 11 according to state-linked media.

Aramco has not yet unveiled plans to list more of the company on an international exchange, although there have been talks with major world exchanges in recent years.

The company has stated its plans to pay out an annual dividened of at least $75 billion starting in 2020, but questions linger over Aramco's real worth.

While the kingdom's controversial de-facto leader and Crown Prince Mohammed bin Salman has priced the company's value at $2 trillion, analysts estimate the value is closer to $1.5 trillion.

Based on a $1.5 trillion valuation, a two percent stake sale would help Aramco raise $30 billion.

The state's control of the company also poses multiple risks to investors, as highlighted by the attacks on two key Aramco processing sites in September, which Saudi Arabia and the United States blamed on their mutual foe Iran.

|

| Read more: Aramco attacks expose Saudi vulnerability and shaky GCC security |

The prospectus also noted that the Saudi government ultimately decides the country's level of crude oil production. The kingdom has slashed Aramco's production when it's sought to boost oil prices.

The plan to sell part of the company is crucial to the crown prince's plans for a wider economic overhaul aimed at raising new streams of revenue for the oil-dependent country, with oil prices currently struggling to reach the price range per barrel analysts say is necessary for Saudi Arabia to balance its budget.

Bin Salman has said listing Aramco is one way for the kingdom to raise capital for the country's sovereign wealth fund, which would then be used to finance mega projects across Saudi Arabia as part of the crown prince's Vision 2030.

Plans for news cities - such as the futuristic mega city NEOM, which, at an estimated cost of $500 billion, is the most expensive project in the plan - will be reliant upon the success of the Aramco IPO.

The IPO will also open up the company to unprecedented scrutiny.

"Aramco has never had to answer to investors looking at the company's quarterly results," Ellen Wald, author of the book "Saudi Inc.", told AFP.

"When it goes public, that will change."

Non-qualified investors will also not be able to vote as they will not hold legal title to their shares.

According to a report by the Economic Intelligence group, minority shareholders are unlikely to force any significant shift in the company, but there could be pressure if the stock price underperforms.

"Aramco's past success was partly due to its closed model, where it answered only to Riyadh," the report said.

"Tension seems bound to emerge between the interests of the Saudi state in securing stable oil revenues, the commercial aspirations of a listed Aramco, and the crown prince's vision that must somehow satisfy both."

'Bullying' the ultra-rich to buy in

Among those approached by the kingdom's government to buy stock in Aramco are the wealthy Olayan family and Prince Alwaleed bin Talal.

Prince Alwaleed, who was ranked by Forbes as the world's 45th richest person in 2017, was the most high-profile detainee among 350 suspects rounded up by Saudi authorities in a 2017 anti-corruption drive and held in Riyadh's Ritz-Carlton hotel.

Follow us Twitter and Instagram to stay connected