Coronavirus and falling oil production continue to shrink Saudi economy

As required by its commitments to the Organization of Petroleum Exporting Countries (OPEC), Saudi Arabia continued to limit its output of oil, which played a role in the country’s GDP shrinking by 4.6% from July to September 2020, although this contraction was not as severe as the 7% slump which happened in the previous quarter, from April to June, when the country waded through the worst part of its coronavirus crisis.

The quarter from July to September saw the nation’s oil output drop by 8.2%, as OPEC nations continue to limit production in an effort to stop prices falling.

Despite the economic slump, sprouts of growth were witnessed in the country’s non-oil sector, which only declined by 2.1%, representing a marked improvement from the previous quarter, which saw a contraction of 8.2%.

Saudi Arabia has witnessed a steady decline in the number of new daily cases of coronavirus since they peaked in the middle of June, and has imposed no new restrictions since May. Businesses have been permitted to reopen and with the recent start of a vaccination programme, it is believed that the country could avoid another wave of infections.

Between July and September, Saudi Arabia pumped an average of 8.8 million barrels a day, down from the 9.3 million pumped daily in the previous quarter and also lower than the 9.4 million pumped daily the previous year.

|

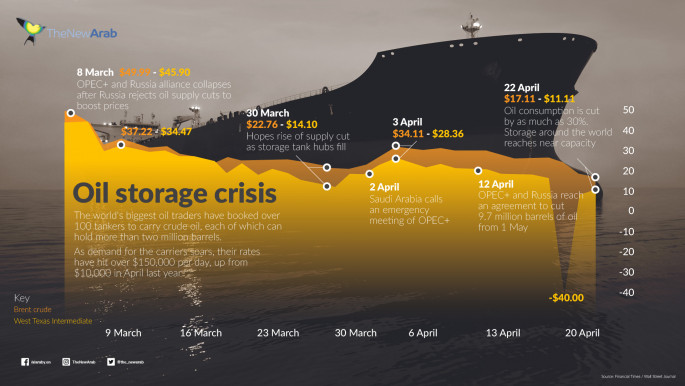

In March, Saudi Arabia attempted to assert its dominance over other oil producing nations by starting a price war. This coincided with a global fall in demand due to the coronavirus pandemic. The kingdom’s gambit ultimately failed and resulted in a 65% fall in crude export revenues, compared to the previous year.

With oil production cuts expected to continue, and government spending cuts implemented alongside other austerity measures, including a sharp rise in VAT, growth is predicted to remain minimal, if not elusive.

Read more: Less than zero: Saudi Arabia's role in crushing the US oil industry

On Tuesday, Saudi Arabia released its budget for 2021, and the country's finance minister, Mohammed al-Jadaan, said that they were seeking to prioritise financial discipline and narrow the kingdom’s deficit to 4.9% of GDP, down from 12%.

According to Jadaan, the budget reflects, “the ability to adopt appropriate policies to balance between growth, economic stability and fiscal sustainability in the medium and long term.”

Economic growth in non-oil related sectors are a crucial part of Crown Prince Mohammed bin Salman’s Vision 2030, which seeks to diversify the nation’s economy, create jobs, and boost tourism to the Gulf state.

Follow us on Facebook, Twitter and Instagram to stay connected

![Saudi economy fails to achieve growth[Getty Images] Saudi economy fails to achieve growth[Getty Images]](/sites/default/files/styles/large_16_9/public/media/images/179903A1-E48E-4A28-B23E-B6F9537D6AE2.jpg?h=d1cb525d&itok=nEs4poHg)