Qatar one of London's biggest landlords as portfolio expands

Qatari Diar Real Estate Investment has recently announced a $2 billion deal to create a home-rental business in London.

The property development arm of the Qatar Investment Authority (QIA) has teamed up with UK developer Delancey Real Estate and a Dutch pension fund to manage an eventual portfolio of 4,000 homes in the UK capital.

The properties are located in the former Olympic athletes' village in Stratford, which was bought by Qatari Diar and Delancey Estates in 2011 for $794 million, as well as in Elephant & Castle in central London.

"This merger between two leading London private rented-sector schemes is the first step in what is a much larger endeavour; to significantly increase the supply of new homes in connected and affordable locations in British cities," said Sheikh Jassim al-Thani, chief development officer in Europe and the Americas for Qatari.

"We are delighted to have forged this important partnership, which we are confident will play a leading and very positive role in the future of the UK's residential investment sector."

Jamie Ritblat, founder and chief executive of Delancey, said the merger marked the end of the beginning for efforts to "deliver desperately needed innovation, scale and true customer experience to the UK's residential market".

Subject to regulatory approval, the venture will manage 4,000 homes, 1,500 of which are already built, and it will be operated under the Get Living London brand.

Meanwhile, the property development company has also announced plans to transform the US embassy in London into a five-star hotel as part of its latest developments across the city.

The company bought the listed building in 2009, and the US will move its diplomatic presence in London to Vauxhall next year.

|

This merger between two leading London private rented-sector schemes is the first step in what is a much larger endeavour; to significantly increase the supply of new homes in connected and affordable locations in British cities. - Sheikh Jassim Al Thani |

|

Qatari Diar is part of Qatar's sovereign wealth fund, which was founded by the Gulf emirate to strengthen its economy through diversification.

The real estate company has stakes in French construction giant Vinci SA, utilities companies Suez Environment and Veolia, and Port Tarraco Marina in Spain.

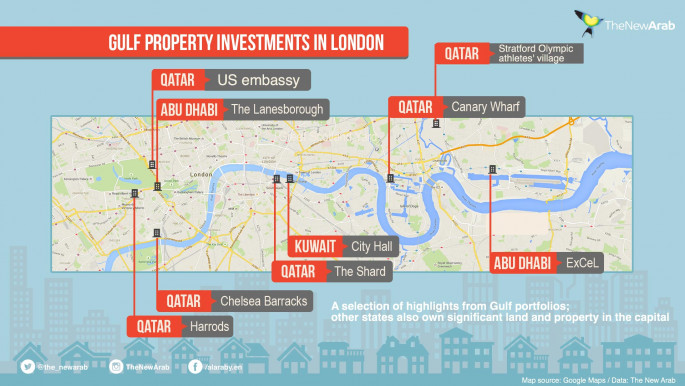

In London, Qatar owns landmarks including The Shard and Canary Wharf, as well as 34 percent of the top 15 most expensive skyscrapers in the city. It also owns £1 billion of property in Mayfair, and 20 percent of Heathrow Airport, among other properties, according to an online newspaper for London's business community.

Other Gulf states have also invested in London's booming property market, mainly luxury houses and apartments, as well as grand hotels, department stores and skyscrapers.

The sovereign wealth fund of the UAE's largest emirate, the Abu Dhabi Investment Authority (ADIA), is the second largest in the world, after Norway, with assets of $773 billion. Saudi Arabia's is third, and Kuwait's fifth.

The ADIA owns the prestigious Lanesborough hotel, and the emirate's state exhibition wing owns the ExCeL centre, which housed several events during the 2012 London Olympics.

Kuwait, meanwhile owns City Hall, the seat of the mayor of London, and the surrounding area.

|

![The Shard, London [Getty] The Shard, London [Getty]](/sites/default/files/styles/image_345x195/public/media/images/15E50BE3-7677-456E-9989-F26E120CB161.jpg?h=d1cb525d&itok=dOIHyCq3)