Follow us on Facebook, Twitter and Instagram to stay connected

Oil rebounds in Asia after Saudi Arabia output cut

Oil rebounded in Asian trade Tuesday, buoyed by Saudi Arabia's decision to cut output more than it had pledged as the virus-hit world economy cautiously emerges from lockdown.

US benchmark West Texas Intermediate for June delivery was up 1.37 percent at $24.47 a barrel in morning trade.

Global benchmark Brent for July was trading 0.71 percent higher at $29.84 a barrel.

Both contracts settled lower Monday after big week-on-week gains Friday.

"Oil prices drew some relief overnight after Saudi Arabia announced they would cut a further 1 million barrels per day in June, bringing their daily production to just under 7.5 million barrels per day," AxiCorp global market strategist Stephen Innes.

"This reduction in production provided excellent optics encouraging other OPEC+ members to comply and even offer additional voluntary cuts, which should quicken the global oil markets' rebalancing act," he said, referring to the Organization of Petroleum Exporting Countries and their partners.

Read also: Saudi triples VAT, suspends handouts in virus-led austerity drive

ANZ Bank said the move would take Saudi Arabia's output to the lowest level since mid-2002.

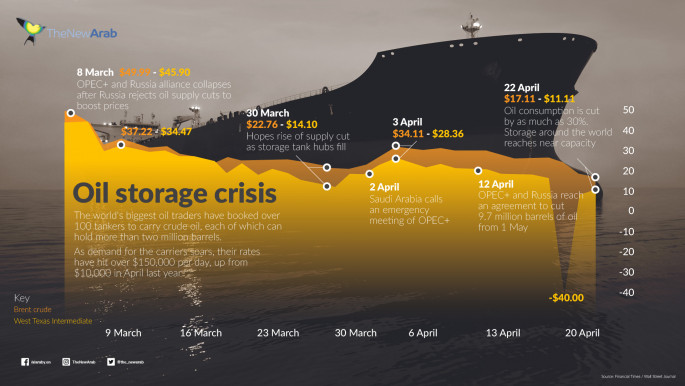

Top crude producers agreed last month to slash output by 10 million barrels a day from May 1 after prices crashed to below zero as lockdowns to contain the coronavirus pandemic sapped global demand and supplies swelled.

Kuwait said it would cut an additional 80,000 barrels per day and the United Arab Emirates announced it would slash 100,000 bpd to support Saudi Arabia's move.

Doubts, however, remain about "the ability of producers to implement and sustain the cuts," ANZ Bank said in a note.

"Producers also seem ready to increase output as soon as prices rebound."

At the same time, analysts said moves to gradually reopen businesses have increased the risks of a second wave of virus infections.

Innes said there remains a "high degree of trepidation around... the risk of new outbreaks of the virus arising," citing pick ups in infections in Germany and South Korea.

"Unfortunately for global markets in general, this will continue to be a theme likely until effective vaccines are made available to the masses," he said.