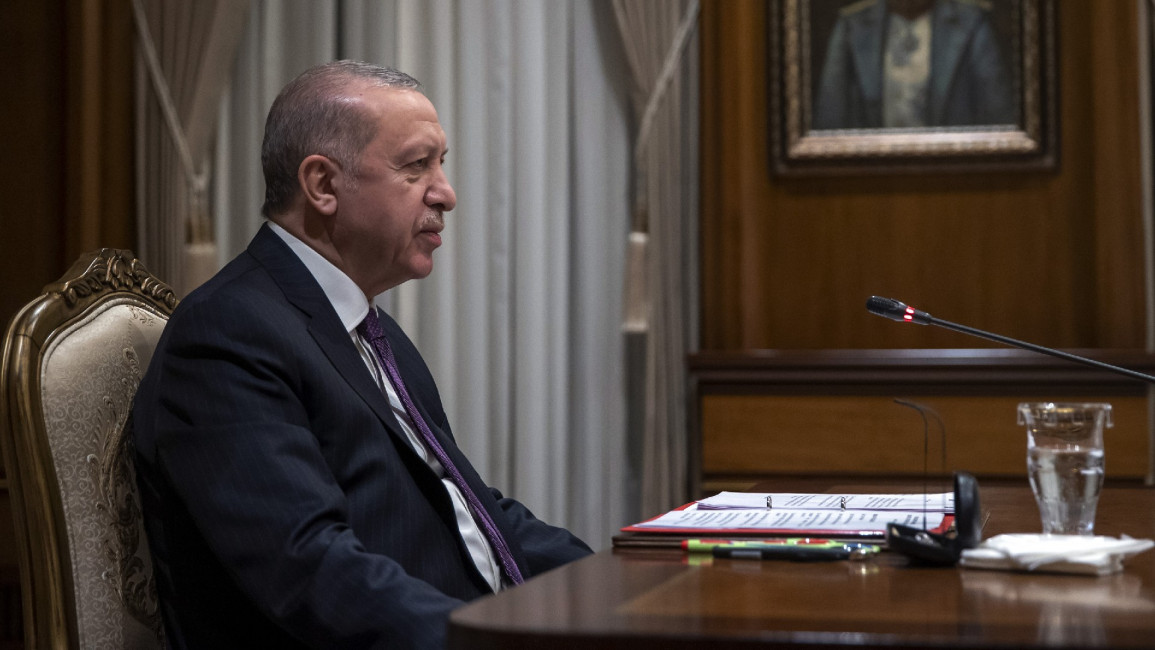

Turkish markets sink after Erdogan fires top banker

The Turkish lira and stocks plunged Monday as officials tried to stem the carnage caused by President Recep Tayyip Erdogan's abrupt dismissal of his reformist central bank chief.

The lira lost nearly 15 percent against the dollar on the first day of trading after Erdogan replaced market-friendly economist Naci Agbal with former ruling party lawmaker Sahap Kavcioglu at the crucial post.

It clawed back some of its losses but was still down nine percent at 7.93 to the dollar late Monday after analysts said state banks intervened to support the lira by selling foreign currencies.

David Madden of the CMC Markets brokerage in London said the rout was driven by "fears that Turkey will impose capital controls" while Capital Economic pointed to banks laden with foreign currency debts as "a key area of vulnerability".

The turmoil carried over to the Istanbul stock exchange.

The Borsa Istanbul suspended trading twice when automatic circuit breakers kicked in as the broad market ended the day down 9.8 percent.

Yields on Turkish bonds reached record highs and people on the street worried about their savings being wiped out by Erdogan's decision to fire the man credited with righting the economy in his four months on the job.

"Supporting the government doesn't mean turning a blind eye to its mistakes," Sukru Kocak, 36, said on his way to work in downtown Istanbul.

'Lack of predictability'

The violent market reaction underscored the trust Agbal had won from investors after years of what many Western analysts view as mismanagement by Erdogan's economic teams.

Moody's ratings agency said the sudden change offered "further evidence of the complete lack of policy predictability in Turkey and confirms our view of serious institutional weakening".

Erdogan is known for his unconventional belief that high interest rates cause inflation -- instead of tamping it down -- and has placed a heavy emphasis on keeping them low to support growth.

The result saw the Turkish economy expand by 1.8 percent last year despite the pain of the coronavirus pandemic.

But the annual inflation rate also shot up to 15.6 percent by February and the Turkish lira lost nearly a third of its value against the dollar from the start of 2020 to the day of Agbal's appointment in November.

He used his term to aggressively raise the main interest rate and promised to keep it high for as long as needed.

Government reassurances

Erdogan seemed to grudgingly accept the policy change.

But Agbal's decision to hike the main rate by a larger-than-expected 200 basis points to 19 percent last Thursday appeared to be the last straw for Erdogan.

Agbal's replacement Kavcioglu had written columns for the pro-government Yeni Safak newspaper arguing that high rates "indirectly" caused inflation.

The new central banker is "more closely aligned with Erdogan's unconventional economic notions," Britain's Moneycorp brokerage said in a research note.

Turkish officials tried their best to reassure the markets in a series of statements over the weekend and Monday.

"There will be absolutely no move away from the free market mechanism," Finance Minister Lutfi Elvan said.

"We will continue with determination to implement the liberal exchange system."

'Tight spot'

Kavcioglu himself said Sunday the central bank will "continue to use monetary policy tools effectively in line with its main objective of achieving a permanent fall in inflation".

But economists worry that Kavcioglu's means of fighting inflation involves bringing the interest rates down.

OANDA brokerage analyst Jeffrey Halley said Kavcioglu "is in a tight spot. Cut rates and see foreign investors flee, inflation spike and the currency crumple, or hike rates and get fired."

Citizens on the streets of Istanbul meanwhile worried about rising unemployment -- officially registered at 13.2 percent at the end of 2020 -- and their liras being able to buy less in stores.

"Of course all this affects us," said Ahmet, 60, who is unemployed.

"We can't even find a job anymore. And when we go out shopping, the prices are constantly changing. I really don't know what will happen to us."