Iran doubles oil production, fuelling regional rivalries

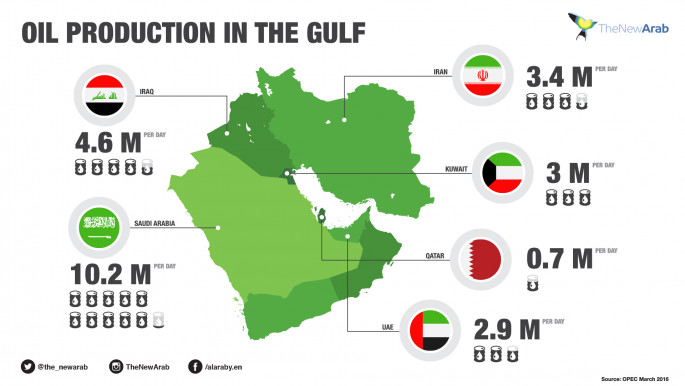

The increase not only marks a striking influx of cash for the Islamic Republic's sanctions-hit economy, but also a key milestone in Iran's fierce competition with regional rival Saudi Arabia.

Oil production rose to 3.8 million barrels per day from a low of 2.9 million in the past five months, Iranian oil minister Bijan Zanganeh said on Tuesday.

"Iran's oil exports have doubled since February," SHANA news agency quoted Zanganeh as saying.

According to these new figures, Iran is producing oil at its highest rate for five years, making it the greatest source of growth in oil supply among OPEC countries.

The historic nuclear deal with world powers in January 2016 - which led to the lifting of long-running sanctions - opened Iranian oil to crucial new markets.

"Iran has done an impressive job in increasing oil production since nuclear export sanctions were lifted in January 2016," IHS oil analyst Spencer Welch told The New Arab.

But questions remain over the sustainability of this increase as Iran's oil industry suffers from chronic under-investment and aging technology.

|

| [Click to enlarge] |

"Maintaining this level will be harder, as money is needed to carry out repairs to equipment and also for new drilling to replace existing wells," Welch said.

"Many of Iran's existing wells are more than 70 years old."

Tehran may have its eyes fixed on foreign investment to generate much-needed revenue.

"The Iranian oil industry, and country as a whole, has been starved of cash for a number of years because of the sanctions," Welch told The New Arab.

"The Iranian government is working on a 'new oil contract' in order to attract the required foreign investment, but this will take time," Welch added.

Until then, the Islamic Republic may face a dip in oil production.

"In the meantime Iranian oil production could reduce a little, until the necessary investment is in place," Welch said.

Amid the backdrop of fierce geopolitical rivalry between Iran and Saudi Arabia, the return of Iranian oil to the pump has taken on a new significance.

"The additional Iranian oil onto the market has created a market share battle, particularly between sour crude producers, including Saudi Arabia and Iraq," Welch told The New Arab.

However, the struggle could be one afflicting both states as their insistence of over-supplying continues to dampen the price of oil.

"The sour crude market is oversupplied in Europe and Asia, and sour crudes are generally at historic low values," Welch said.

While the oil markets remain volatile, and Iran's capacity to produce oil at current rates remains uncertain, the announcements will nonetheless inject a new degree of confidence in the Iranian oil industry and worry regional rivals alike.

Follow Sarah Khalil on Twitter: @skhalil1984