'Pivoting East': Will China come to Lebanon’s rescue?

Faced with an accelerating economic collapse, US political pressure and complex IMF bailout talks, Lebanon's Hezbollah-backed government has started to tout an 'eastern economic pivot' to Communist China but experts warn this may be little more than a pipe dream.

It all started with a recent speech by Hezbollah chief Hassan Nasrallah, the most powerful figure in Lebanese politics today.

"Chinese companies are ready to bring in money, and without any of the complications that we talk about in Lebanon. We don't have to give them money, they will bring money into the country," Nasrallah told his supporters via video link on June 17.

Since then, Hezbollah-friendly media outlets began to tout a Chinese multi-billion-dollar investment package, triggering an internal debate as the country grapples with its worst economic crisis in recent memory and inviting a US-Chinese war of words over Lebanon, which receives tens of millions of dollars in military and economic aid from Washington as part of the US strategy of containing Iranian influence in the region.

Initially, the government remained coy about these reports, only saying it would consider cooperating with all sides who offered it.

But after weeks marked by high-level resignations from Lebanon's team of negotiators with the IMF, an unprecedented deterioration in the value of the national currency against the dollar, a diplomatic crisis with the US, and a bread and fuel crisis, the prime minister changed tack.

|

"Chinese companies are ready to bring in money, and without any of the complications that we talk about in Lebanon," Nasrallah told his supporters. |  |

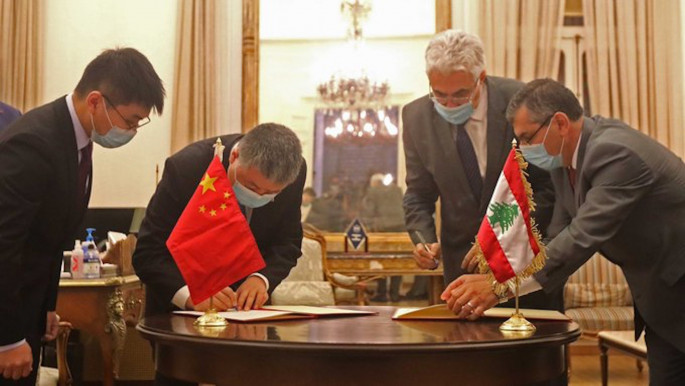

On Thursday, Prime Minister Hassan Diab invited the Chinese ambassador to Beirut Wang Kejian to a meeting with the ministers of public works, transport, tourism, energy, and environment.

Although the meeting signalled both the Lebanese government and China are serious about economic cooperation, most experts interviewed by The New Arab and others quoted in press reports remain sceptical both about China's intentions and its worth as an alternative to Western and Arab donors.

|

|

Reported investment figures are likely to be exaggerated [Twitter] |

Lebanon has been seeking a $10 billion bailout package from the IMF to tackle its worst economic crisis in decades, triggered by a triple currency, sovereign debt, and banking crisis that has seen Lebanon default on foreign debts for the first time in its history.

If negotiations are successful, the package would unlock a further $11 billion capital investment package pledged in 2018 during the CEDRE conference of Western and Arab donors.

After launching in May with Hezbollah's conditional consent, the talks with the IMF have now reached an impasse.

The immediate obstacle are the sharp differences within the Lebanese side over how to calculate and assign the losses on the Central Bank and banking sector's balance sheets, which has triggered two high-level resignations from Lebanon's negotiating team in recent weeks.

The banking lobby wants to spare high-worth depositors from a so-called haircut and grant them shares in state assets in return for the government debt they hold, while the government is pushing for a haircut on these depositors arguing they played a key role in the current collapse through high-risk, high-interest financial engineering.

|

After launching in May with Hezbollah's conditional consent, the talks with the IMF have now reached an impasse. |  |

Yet many say the real obstacle are the strict reforms and forensic accounting demanded by the IMF, something that would expose the entrenched corruption of Lebanon's ruling class over the past three decades, which most Lebanese blame for their current woes.

At the same time, Lebanon is coming under tough US and European pressures, who are reluctant to rush to Beirut's aid due to the links maintained by Hezbollah, a key component and backer of the current government, with Iran and the Syrian regime.

Whether or not there are political strings attached to an IMF bailout remains an open question, but US and EU sanctions on Syria are already hitting Lebanon, and the prospect of further sanctions on Lebanese entities by the US, which temporarily cut off military aid to Lebanon in December, is increasing every day Hezbollah and its close allies remain part of the government.

The ongoing freefall of the local currency has meanwhile reignited popular demonstrations, while half of Lebanon's population is already estimated to live below the poverty line and many struggling to afford food and medicine.

It is no surprise then that the Lebanese government is looking elsewhere for a fix, real or imaginary.

The 'China bailout': Hyperbolic pipe dream?

Following Nasrallah's speech last month, details of an alleged Chinese investment package were published by sympathetic media, most recently on Friday in pro-Hezbollah newspaper Al-Akhbar.

According to these reports, Chinese firms, including state-linked entities, are interesting in investing up to $12 billion in ports, railroad, power generation and waste management in Lebanon, amid a crippling electricity and garbage crisis.

Touting the investments as 'sanctions-proof', the reports quoted unpublished official letters allegedly received by the Lebanese government last week, offering "immediate readiness to invest" in Lebanon by Chinese corporations such as state-owned hydropower company Synohydro.

These alleged investments were the subject of the meeting attended by the Chinese ambassador on Thursday, Al-Akhbar suggested.

A Beirut-based Chinese diplomat approached by The New Arab declined to comment on the reported investments, while the Chinese Embassy did not provide a direct statement.

Instead, the embassy's media department referred The New Arab to a series of previously published interviews that shared vague statements on China's interest in "mutually beneficial" and "profitable" investments in Lebanon, in line with its Belt and Road Initiative.

Given the huge Lebanese-Chinese trade imbalance (Lebanon exports $22 million to China and imports $2 billion), critics of the government say these projects are a fantasy, a distraction and an empty promise.

The figures being flouted are likely to be hyperbolic, according to experts who say China is not willing to invest billions in an economic basket case such as Lebanon.

|

The figures being flouted are likely to be hyperbolic, according to experts who say China is not willing to invest billions in an economic basket case such as Lebanon. |  |

"What does Lebanon offer? It lacks proven energy resources. It has access to the Mediterranean, sure, but China already has port investments in Egypt, Greece and Israel [to name a few]. It has a weak industrial base. It just defaulted," Gregg Carlstrom, Middle East correspondent for The Economist wrote on Twitter in response to the reports.

Nafez Zouk, emerging market strategist and economist at Oxford Economics, told The New Arab the figures were "definitely exaggerated".

Zouk suggested the real figures would not be sufficient to save Lebanon's economy on their own. "Based on the estimate of losses and the country's external financing needs, Lebanon needs way more than anything China could provide on its own," he added.

In the wider region, economists seem to agree that Chinese investments follow a path of overpromising and underdelivering, even in relatively stable nations such as Oman and Egypt, which could be the fate of any Chinese pledge for Lebanon.

"For all the hype around Beijing's supposed advantage of state capitalism, through which all its FDI activity in the region counts towards a national political goal, China has not yet proven to be a good investor or a desirable development partner for the Middle East", concluded a report in Bloomberg on Friday.

US-China war of words

Earlier last month, the call to snub the US and seek out Chinese investments led to a war of words between the US Department of State's Bureau of Near Eastern Affairs and the Chinese Embassy in Beirut, amid tensions between the two countries.

|

| The Chinese Embassy said the accusations were "unfounded" [Getty] |

In interviews with local media, David Schenker, Assistant Secretary of State for Near Eastern Affairs (NEA), was quoted as saying Lebanon could soon get sanctioned by the Trump administration and hinting that China had alternative motives for its investments, although his press office has since qualified some of these remarks to The New Arab.

David Schenker "did not say it (Chinese investment) was a 'ploy' but simply underlined that the US is the largest donor to Lebanon in the world and cautioned that China was not a good option for the Lebanese people," the Bureau of Near Eastern Affairs told The New Arab in an email.

Earlier, the Chinese Embassy had said these accusations were "unfounded" and recalled China's medical aid to the country, in reference to personal protective equipment and PCR testing kits donated to Lebanon.

China's assistance to Lebanon still pales in comparison against some $12 million the US allocated to address Lebanon's emerging pandemic-related needs, while the Chinese ambassador previously stated that China had no intention challenge the United States or replace it in regards to Lebanon. The US says it is the top donor to Lebanon, although some dismiss these claims.

China: an IMF 'alternative' or a bluff?

According to experts interviewed by The New Arab, China is unlikely to go against its top trade partner – the US – for a country like Lebanon with so little to offer. Beijing's exit from a multi-billion oil deal with Tehran last year proved that China would not challenge US sanctions over its own interests, and some of the reported Chinese investment plans could fall through.

For example, plans to rehabilitate and operate "a seaport" in Tripoli were also among Chinese projects touted by pro-Hezbollah media. But despite claims made by Nasrallah that the Caesar Act sanctions imposed on Syria's government would not deter China from investing in Lebanon, the Asian giant’s interest in Lebanon's northern Tripoli port relies on a plan to profit off the reconstruction in Syria.

Now, with the Caesar Act in full effect targeting firms and individuals supporting reconstruction efforts that benefit the Syrian government and more sanctions on the construction sector expected to follow, China will probably be discouraged from making large investments in the Tripoli port.

Meanwhile, one of the reforms demanded by the IMF is the closing of illegal border crossings to Syria and the implementation of measures to prevent smuggling. However, such a move would curtail Hezbollah's weapons and other alleged smuggling activities, which may be a strong motivator for the group to suggest alternatives – even with a high chance of failure – as a negotiating tactic.

But if the government and Hezbollah's move to pivot to China is a bluff to negotiate better terms with the IMF, Zouk said he did not believe the IMF would cave to such an approach. The IMF would also need to ensure the loan is repaid, Zouk said, even if the reforms that combat large fiscal leakages wind up hurting Hezbollah.

|

"What Lebanon needs at the present juncture is not just an injection of dollars, but, I would say even more importantly than that, it needs true and meaningful reform," - Nafez Zouk |  |

All this is not to say Lebanon cannot gain some benefit from working with China, even if touting it as an alternative to the IMF is a political manoeuvre.

Indeed, Chinese infrastructure projects, which often contract Chinese firms and fly in Chinese labourers, present an opportunity to bypass Lebanon's politically owned companies which often run these projects and siphon off public funds through corruption and patronage networks.

But Lebanon is still in dire need for internationally overseen reforms to bring about sustainable change to its economy, and China is not known to demand reforms and transparency in return for aid and investment.

"What Lebanon needs at the present juncture is not just an injection of dollars, but, I would say even more importantly than that, it needs true and meaningful reform," Zouk told The New Arab.

"The IMF is a gateway towards securing the kind of international credibility that will allow us to access additional funding, negotiate with creditors, and start bringing confidence back to the local system," Zouk said, adding that the banking sector would also need to be restructured.

"None of those things can be achieved with a few loans from China on their own".

Gasia Ohanes is a journalist with The New Arab.

Follow her on Twitter: @GasiaOhanes